How do I model Defined Contribution and Defined Benefit plans?

Defined Contribution plans

Examples: 401k, IRA, Roth IRA, RRSP, TFSA, and UK Workplace Pension.

Accessing existing Defined Contribution accounts

- Go to Current Finances in the left sidebar.

- Choose Investments.

- Choose the account you want to review.

Adding new Defined Contribution accounts

- Scroll down in Current Finances to Add Investments under the Investments section.

- Choose the correct account type for your country.

- Enter the required details:

- Account Name: Name your account clearly for easy identification.

- Owner: Identify who owns the account – you, your partner, or joint ownership.

- Starting Balance: Enter the initial value of the account.

- Cost Basis: The original value of the account’s investments for tax purposes.

Account settings

- Growth Rate & Dividend Yield: Choose how your account’s growth and dividends are calculated. You can choose the following for each:

- Follow your plan’s Investment and Dividend Yield assumptions.

- Apply a Fixed Rate specific to this account.

- Use the Advanced editor to customize growth and yield behavior in more detail.

- Bond Allocation: Choose how you want bond allocation behavior to be modeled if bonds are active in your plan. (Learn more about how to use bond allocation and location features to optimize your plan)

- Plan settings: Will behave according to your plan’s portfolio-wide bond settings.

- Account settings: Will override your plan’s bond allocation settings for this account.

- Liquidity and Withdrawals: Manage account liquidity, age-based rules, and penalties with these options

- Allow Withdrawals: Choose when withdrawals are permitted

- Always

- Never

- After Qualified Withdrawal Age

- After Reaching a Specific Year

- Display Account as Liquid: Choose when the account is displayed as liquid

- Always

- Never

- When Withdrawals are Allowed

- After Qualified Withdrawal Age

- Early Withdrawal Penalties: Enable or disable penalties for early withdrawals. If enabled, you can

- Set the Qualified Withdrawal Age.

- Specify the Penalty Rate for an early withdrawal.

- Allow Withdrawals: Choose when withdrawals are permitted

- Required Minimum Distributions (RMD): Select the appropriate RMD type if needed.

- Roth Conversions: Allow you to move funds from a traditional retirement account to a Roth IRA, which can provide tax-free withdrawals in retirement. (Not available for all accounts.)

- 72t (SEPP) Withdrawals: Configure the start of 72t distributions for penalty-free early access to retirement funds following IRS rules.

Adding contributions to Defined Contribution Plans

- Go to the Cash Flow Priorities (CFP) tab.

- Select or add a Defined Contribution account.

- Enter contribution details:

- % of earnings (based on salary.)

- % of earnings up to limit (caps at user-defined yearly limit.)

- Amount in today’s currency (inflation-adjusted.)

- Amount in actual currency (fixed contributions.)

Managing contributions

- Use “Contributions are fixed” to prioritize hitting your contribution target, even if other accounts must be drawn down to do this. Typically, you should place this CFP at the top of your priority list.

- If “Contributions are fixed” is turned off, the “Reduce employer contribution if yours is not achieved” option will automatically activate. This reduces the employer contribution if your contributions fall short due to insufficient income.

Defined Benefit plans

Defined Benefit pensions provide fixed payouts based on your salary history and employment tenure.

Option 1: How to add to an existing salary

- Click on an existing Salary in the Income section of your plan.

- Scroll down on that Salary to More Options and enable “Has Defined Benefit Pension”. Then, under “Yearly Payout Type”, select a calculation:

- % of final salary: Calculates your pension based on the final salary in your plan connected to this “Has Defined Benefit Pension” option.

- % of average salary: Uses an average of your salary across your career connected to this “Has Defined Benefit Pension” option.

- Fixed amount in today’s currency: A set payout value adjusted for inflation. (Learn more about understanding Today’s Currency vs Actual)

- Toggle “Payouts are Tax-Free” if applicable to the pension.

Option 2: How to add as a separate pension income

- Add the pension benefit directly in the Income section below the main plan view in the Plan tab as “Pension Income.”

- Note: This method doesn’t include the option to model the pension based on your average or final salary, as with Option 1.

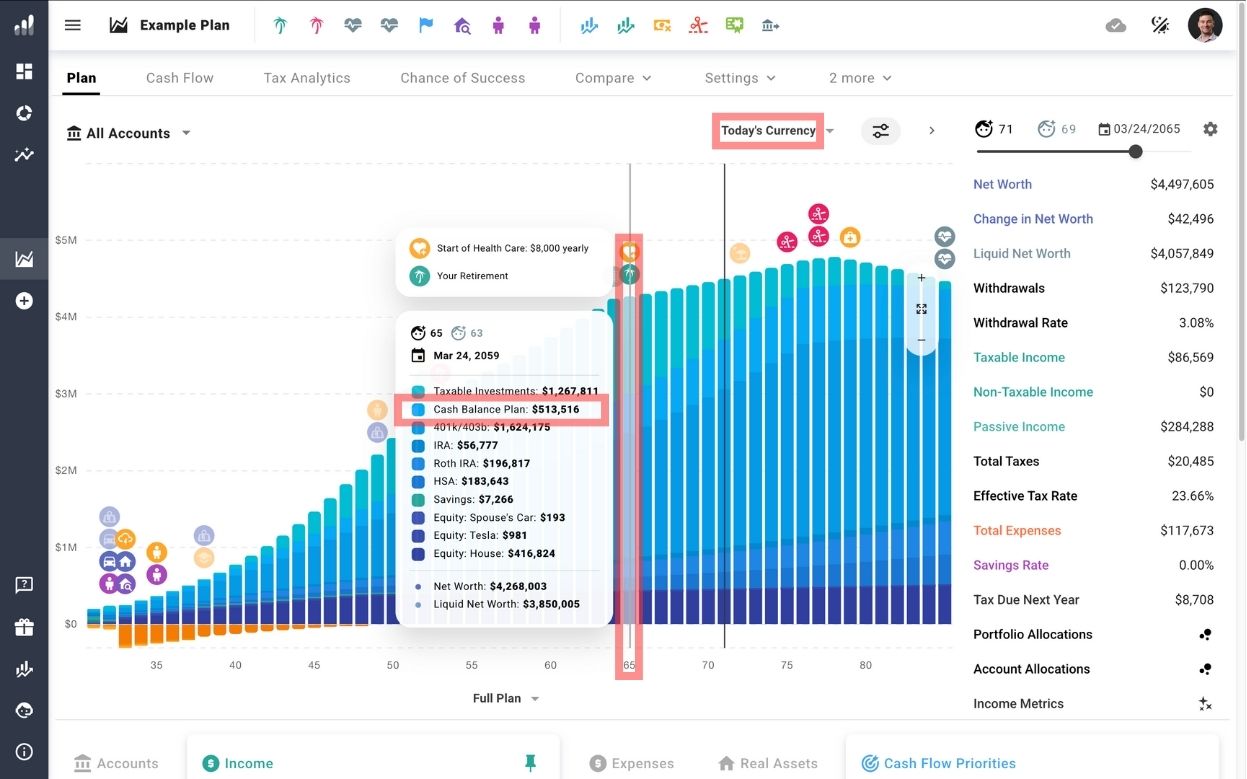

Cash Balance Plan

Modeled as a Defined Contribution account that transitions into treatment as a Defined Benefit pension.

Steps to model:

- Set up a Defined Contribution account following the instructions above.

- Make the account illiquid until the desired Qualified Withdrawal Age.

- At the Qualified Withdrawal Age:

- Use the “View Granular Plot” in the Net Worth metric to the right side of the screen to find the Cash Balance Plan’s account balance for this year.

- Use the Account Transfer method to zero out the account and add an Income entry to reflect its converted value as annuity income. Be sure to note whether you’re withdrawing in Actual or Today’s Currency terms.