Where are my first year taxes?

Taxes do not appear in the first year of the plan, but are included in all subsequent years.

Why this happens:

- ProjectionLab’s timeline begins with your chosen start year, so it lacks data on previous year activity or tax liabilities.

- As a result, taxes owed from the year before the plan begins won’t appear as a tax return payment in the first year.

Settling previous year’s taxes in your plan’s first year:

- If you’ve already made your payment or received your refund, no action is required, because your Current Finances should already reflect this information.

- If there is a pending payment due or refund expected, you can handle this with a custom expense or income item.

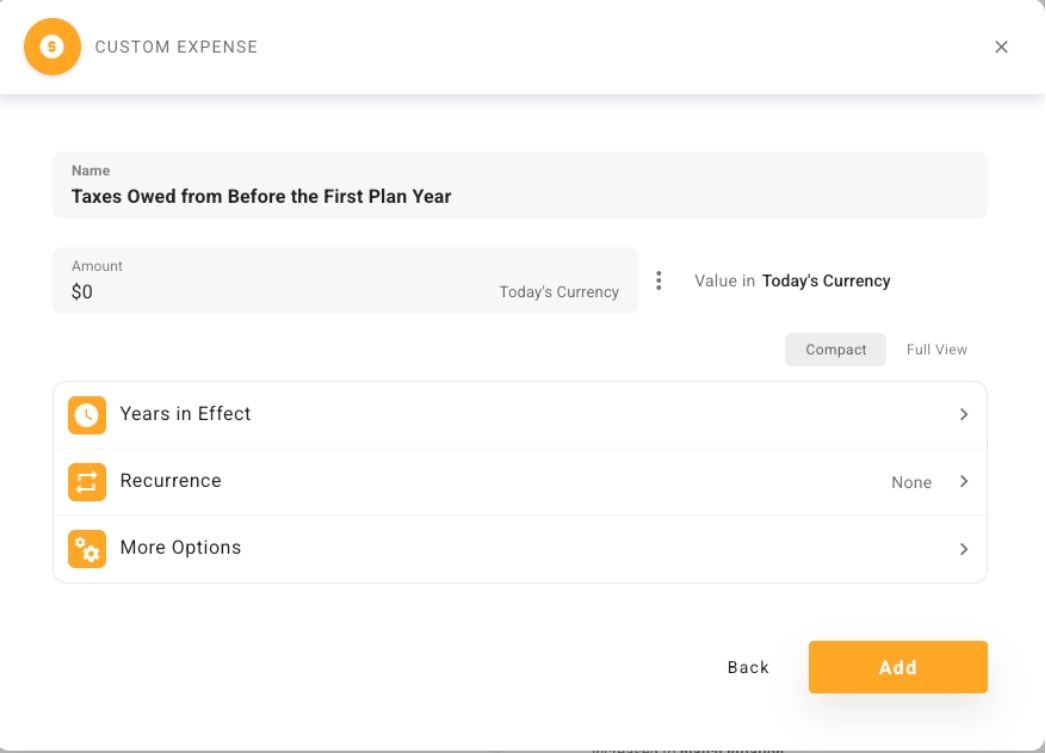

- Create a custom expense for the first year to account for any taxes owed from the previous year.

- This ensures your cash flow accounts for the pending tax payment from the previous year’s lability.

- Note: This is different from tax withholding, which covers current-year income. The first-year tax payment covers taxes owed from the previous year, not those deducted from this year’s paycheck.

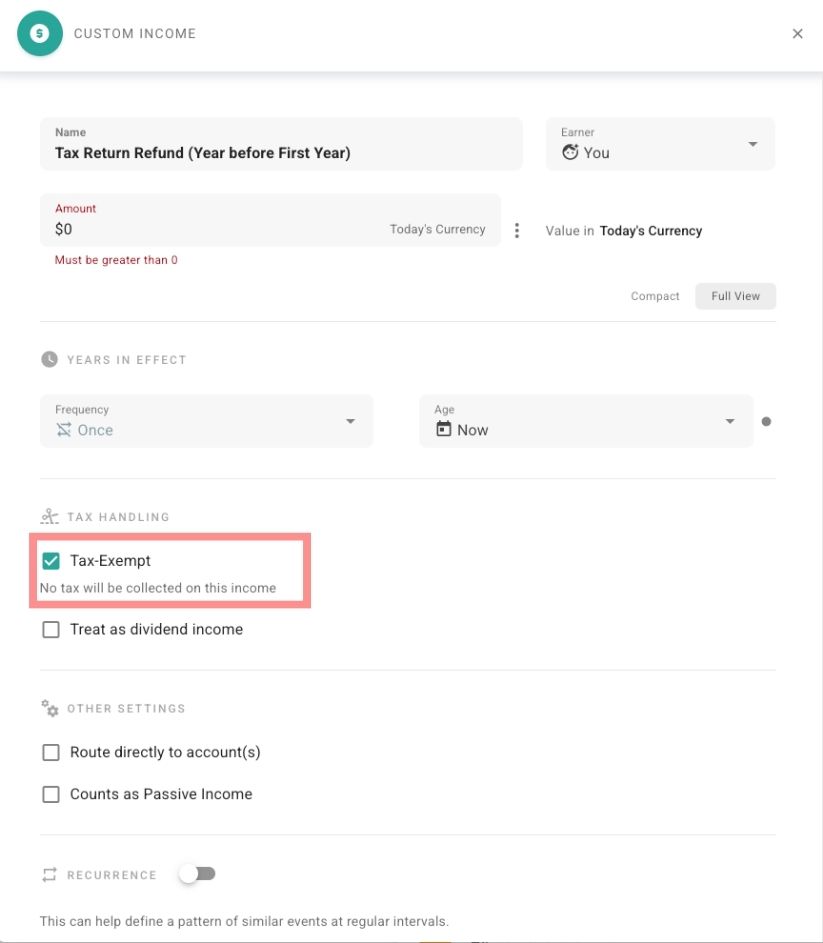

- If you’re expecting a tax return refund in the first year of your plan, add it as a custom income item marked, “Tax-Exempt.”

Additional tips

The Tax Analytics and Quick Tips videos explore how taxes are calculated in more detail.